Green finance initiatives: unlock funding for a sustainable future

Anúncios

Green finance initiatives promote sustainable projects by providing funding through mechanisms like green bonds and climate funds, addressing environmental issues while fostering economic growth.

Green finance initiatives play a crucial role in driving sustainability across industries. Have you considered how these efforts can help tackle climate challenges while promoting economic growth?

Anúncios

Understanding green finance initiatives

Understanding green finance initiatives is essential for promoting sustainable economic growth. These initiatives aim to support projects that have positive environmental impacts. By exploring various approaches, we can see how finance plays a pivotal role in achieving sustainability goals.

What Are Green Finance Initiatives?

Green finance initiatives involve capital investments directed towards projects that help protect the environment. This includes renewable energy, waste management, and sustainable agriculture.

Key Characteristics of Green Finance

These initiatives typically have several key traits:

Anúncios

- Environmental Impact: Projects must demonstrate clear benefits to nature.

- Long-term Viability: Investments should sustain environmental protection over time.

- Innovation: New technologies that enhance sustainability are often prioritized.

Understanding these characteristics helps businesses and investors recognize valuable opportunities in the market. Furthermore, it promotes greater commitment to environmental standards in competitive sectors.

Benefits to Investors

Investing in green finance also offers considerable advantages for stakeholders. For instance, it can enhance a company’s reputation as a forward-thinking and responsible entity. Additionally, green investments provide access to new customer bases looking for sustainable options.

As the global market shifts towards sustainability, embracing green finance initiatives will become increasingly essential. This creates a win-win situation for both the economy and the environment.

Key benefits of green finance

Exploring the key benefits of green finance reveals the enormous potential for positive change. These benefits extend beyond just financial returns, impacting the environment and society in essential ways.

Environmental Impact

One of the most significant advantages of green finance is its ability to foster projects that directly contribute to environmental conservation. By investing in renewable energy and sustainable practices, businesses can reduce their carbon footprint. This leads to a healthier planet and supports biodiversity.

Attracting Investment

Another major benefit is the ability to attract investment. As public awareness about climate issues increases, investors are looking for sustainable opportunities. Green financing not only appeals to eco-conscious investors but also enhances a company’s marketability.

- Positive Public Image: Companies involved in green finance often enjoy a better reputation.

- Access to New Markets: Sustainable practices can open doors to environmentally focused consumer bases.

- Long-term Savings: Investing in energy efficiency can lower operational costs over time.

These elements work together to create a compelling case for adopting green finance. Furthermore, companies that embrace sustainable practices are likely to lead their industries as more regulations favor environmental responsibility.

Regulatory Support

Governments worldwide are increasingly supporting green initiatives through grants and favorable regulations. Companies adhering to green finance principles may benefit from tax breaks or subsidies, making sustainable investments even more appealing.

In essence, the myriad benefits of green finance not only pave the way for financial growth but also enrich the community and environment, driving a change that is long overdue.

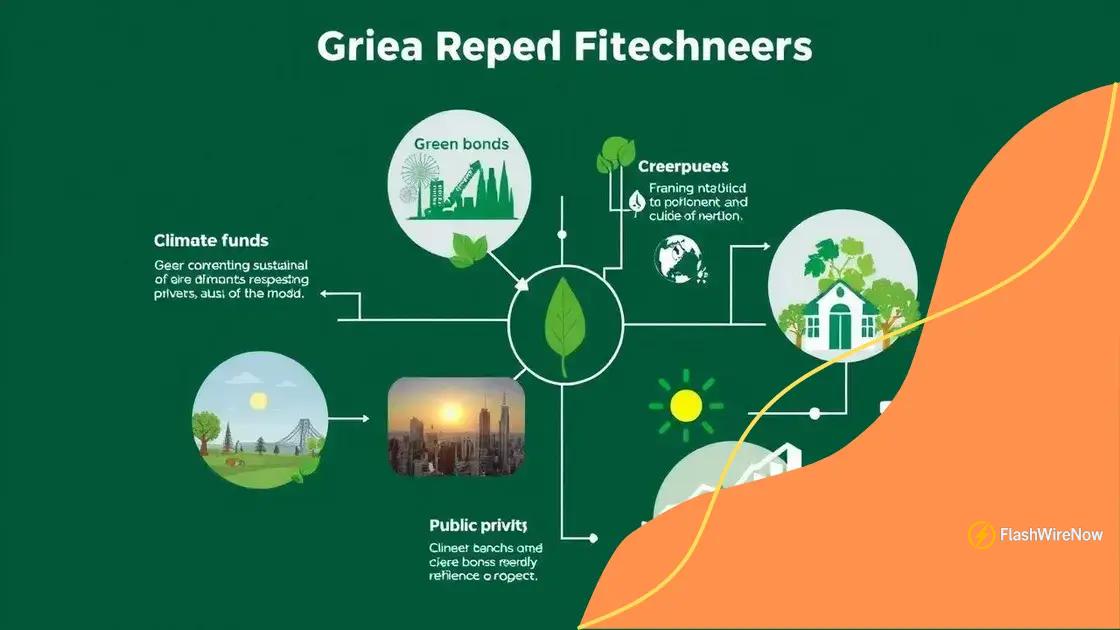

Types of green finance mechanisms

Understanding the types of green finance mechanisms is key to leveraging funding for sustainable projects. These mechanisms help channel financial resources into initiatives that protect the environment.

Green Bonds

One popular mechanism is green bonds. These are fixed-income securities designed to raise funds specifically for projects with positive environmental impacts. Investors can contribute while also receiving returns on their investments.

- Funding Renewable Energy: Green bonds often finance solar, wind, and other renewable energy projects.

- Promoting Sustainable Infrastructure: They can also support the development of eco-friendly buildings and transportation systems.

This makes green bonds an attractive option for both issuers and investors looking to support sustainability efforts.

Climate Funds

Another mechanism is climate funds. Managed by governments or international organizations, these funds are designed to support adaptation and mitigation projects in developing countries.

- Financial Assistance: They provide grants and investments for critical projects.

- Capacity Building: These funds help countries develop skills and technologies for sustainable development.

- Raising Awareness: They also promote understanding of climate change impacts and policy solutions.

This system helps developing nations gain access to resources necessary for sustainable growth.

Public-Private Partnerships

Public-private partnerships (PPP) are another effective way to finance green initiatives. These collaborations combine public sector support with private sector efficiency. Through PPPs, projects can benefit from shared risks and pooled resources. This allows for larger-scale environmental projects that might not be feasible for a single entity.

As we explore these mechanisms, it becomes clear that they pave the way for innovative finance solutions focused on a greener future.

Challenges in green financing

Identifying the challenges in green financing is crucial for understanding the barriers to sustainable investments. Despite the significant benefits, various obstacles can hinder the flow of funds into green projects.

High Initial Costs

One major challenge is the high initial costs associated with green projects. These projects often require substantial upfront investment in new technologies and infrastructure. For instance, while renewable energy sources like solar and wind are becoming cheaper, the initial installation can still be costly.

- Funding Availability: Securing sufficient capital can be difficult for startups and small businesses.

- Risk Perception: Investors may perceive green projects as risky investments, which can deter financing.

As a result, many potential green initiatives fail to launch due to lack of financial resources.

Regulatory Barriers

Another significant hurdle involves regulatory frameworks that may not support green financing. Many regions have outdated regulations that do not encourage sustainable practices. These regulations can create uncertainty for investors, leading to hesitancy in funding green projects.

Shifting these regulations to favor green investments is crucial for promoting sustainable growth.

Lack of Awareness

Furthermore, there is often a lack of awareness around green finance options. Many businesses and individuals are unaware of the financial mechanisms available to them. This lack of knowledge can prevent them from pursuing sustainable investment opportunities.

Educating stakeholders on these options is essential for driving more investments into green projects. By understanding the potential for financial and environmental returns, investors may be more inclined to engage in green financing.

Despite these challenges, concerted efforts towards education, robust regulatory frameworks, and addressing initial costs can help overcome the barriers faced in green financing.

Case studies in successful green finance initiatives

Examining case studies in successful green finance initiatives reveals how innovative financing strategies can lead to substantial environmental and economic benefits. Looking at real examples helps us understand the impact and effectiveness of green financing.

1. The Green Bond Market Expansion

One notable case is the expansion of the green bond market. In recent years, cities and companies have issued green bonds to fund sustainable projects. For example, the City of San Francisco used green bonds to finance its renewable energy initiatives and upgrades to public transportation. This funding mechanism has proven attractive to investors who seek both profit and positive environmental impact.

- Project Financing: Funds raised have been allocated to solar energy installations and energy-efficient buildings.

- Investor Engagement: Greater investor interest has stimulated further green projects.

This shows how successful implementation can gain traction and encourage others to follow suit.

2. Renewable Energy Projects in Developing Nations

Another example comes from developing nations leveraging green financing for renewable energy projects. In Kenya, for instance, the government partnered with international lenders to fund solar power initiatives. This resulted in increased access to energy in rural areas, improving living conditions and supporting local economies.

The project not only boosted the energy supply but also created green jobs, demonstrating how green finance can contribute to economic growth.

3. Corporate Sustainability Efforts

Many corporations are now adopting green finance principles. A successful instance is when a multinational company committed to reducing its carbon footprint by investing in sustainable practices across its supply chain. This company issued green bonds to fund these efforts, leading to substantial improvements in operational efficiency and reduced environmental impact.

These case studies highlight the diverse applications of green finance, illustrating how it can facilitate real change. By investing in sustainable solutions, organizations and governments can lead by example and inspire more initiatives in green finance.

FAQ – Frequently Asked Questions about Green Finance Initiatives

What are green finance initiatives?

Green finance initiatives are funding strategies aimed at supporting projects that have positive environmental impacts, such as renewable energy and sustainability efforts.

How do green bonds work?

Green bonds are fixed-income securities issued to raise funds specifically for projects that contribute to environmental conservation, allowing investors to support sustainable initiatives.

What challenges do green financing face?

Green financing faces challenges such as high initial costs, regulatory barriers, and a lack of awareness about available funding options.

Why are case studies important in green finance?

Case studies illustrate the success of various green finance initiatives, providing concrete examples of how funding can lead to economic and environmental benefits.